The Power of Networks and Innovation Ecosystems with Mikel Mangold

After a little break, we are back with another The Innovation Room podcast episode.

In today’s chat, Mikel Mangold shares his insights on the power of networks and innovation ecosystems.

Mikel has previously worked to drive innovation for pharma and health companies. He is currently co-leading the EMEA Innovation Ecosystem Strategy at Lab of NGK SPARK PLUG – a business creation and investment hub, with $100 million fund, which is establishing new revenue streams for the company in mobility, utilities and medical.

Table of contents

Could you tell us a little bit about yourself and your background?

MIKEL: Thank you very much Jesse for this interview. I'm excited for this conversation. My name is Mikel Mangold, and I am a chemist by training. I would say that’s how it all started.

Very early on I was able to move through different environments. I've studied in four different countries. I've traveled and took several breaks, met cultures across continents. I was in Silicon Valley working in incubators, and accelerator. I learned from very successful people. I was mentored by top VCs who have 30+ years of experience in corporate.

So, now I'm back in Europe and I'm trying to create a lot of change. I'm trying to change the mindset of people, and I want to create positive change in the world. I believe in the power of networks to do so.

JESSE: Recently, you became a published author. Can you tell us what is your book about?

MIKEL: In a nutshell, this book is highlighting the need for most of us to change, but not just because it's nice to change. We all need to change: Corporates to survive, individuals to feel fulfilled and purposely driven in their lives. We need to change because we have many problems to solve. The current way of working will not help solve large systemic issues.

My book is basically inspired by Silicon Valley. If you look at the data, they’re not just the best, they are 10x better in terms of startups and innovation compared to the rest of the world. It's a trillion-dollar economy. I'm comparing it with Europe too. Why is it so different here?

So, I'm collecting data about these big differences. It’s about the mindset. In the book I highlight seven mindsets inspired by my interviews (I interviewed 20 people), data and my personal insights on what are the mindset principles that individuals need to adopt to create and build networks.

What are the networks?

In my book, I divide networks in three categories.

1. A network for ideas and knowledge

It's about improving yourself in your research, in your innovation, in this huge company idea that you always had. And by accessing this network, you will achieve the best result.

2. Resources

We all know it, we need money. But that’s not the only need we have. Some will need infrastructure, intellectual property (IP) legal services, production facilities. To really have an impact on the world and to implement ideas in the market, usually you need all of these relationships.

3. The network of people

That can be volunteers, full-time employees or people who just want to support you in whatever you're doing. In the book I talk about how to build that network of people around you, who will support you in creating the change you imagined.

In a nutshell, the purpose of the book is to wake people up and to make them realize that we need to change. People can succeed and thrive in this fast-changing world, and to solve complex problems and systemic issues.

The importance of networks

JESSE: People who are listening to this, most of them are corporate innovators such as yourself. So, I wanted to dive deeper in the why part of it. So why is it so important for us to really network and to be good at it to drive that change for our organizations?

MIKEL: I'm very happy to highlight a few things. I think this is especially relevant to corporate innovators. I’ve observed and would guess that some listeners would agree on this too – we work in silos. Some innovation teams talk about agile and cross functional and so on. These concepts aren’t new; however, I still observe a siloed approach to innovation. These teams do not interact much with the external world, and it is something difficult for me to understand. There have been more than a dozen studies on this.

There is a study called Atypical Combinations [and Scientific Impact]. Its authors studied all these innovators and what they realized was that the best innovators, creating the best change can do it because they were able to create networks with other people. At the same time, they were cross-disciplinary, talking to different departments, different companies and gathering insights. These are the things that made the best innovators.

Another study called [The Sociology of Philosophies:] A Global Theory of Intellectual Change, focused on studying philosophers and mathematicians that really made an impact on the IP level. And it was the same result as the first study: it was people, who had access to others, to exchanging ideas that became the best.

And finally, because I am a scientist, I want to cite another study, “Researchers Go from A to B to Discovery” from Kevin Dunbard. This study started asking scientists how they are making discoveries and they got the same answers “oh, it just happens in the lab”. So, because there were things, they were not sure about, they put cameras in the lab, and tried to observe the scientists. What they realized was that the ones making discoveries were the ones that were interacting the most with other scientists and who were having frequent conversations in the conference room.

What these studies show is that it is so much more about your ability to talk, to exchange with your environment, people, your network. This way you actually become a better innovator and a better person.

So, why are networks so important for corporate innovators? We all know that it’s all about the feedback loop system, especially for products, but also hardware, and some features. It's all about how you validate ideas and get to the good ones, and how you get to what people want. Even if you have tools and processes in place, at the end of the day, it is so much more about asking experts, customers, friends, or colleagues for insights.

The people that have large networks and an opportunity to reach out extensively to different individuals have unfair advantage in that space.

JESSE: I think that's really interesting and a great point that we also like to highlight with a lot of our customers as well. Often there's a bit of too much emphasis on the actual idea that people are working on instead of putting in the work of refining it.

The original idea is never going to be enough. You really need to work on improving it and the feedback from other people is crucial in achieving that.

So, getting the word out, getting valuable feedback, iterating, and validating the idea requires input from other people. And networks are a great way to achieve that.

MIKEL: Yeah, and I’d like to add one more thing to that. What I see right now in the corporate world is that there’s a huge emphasis on processes. Here are all these tools you can use to innovate, or here there’s this book”.

However, what I realized was that people who create change sometimes do not even know these tools. Also, a lot of startups I know did not use any of that. Instead, they had the mindset, and the networks. They had a deep passion for solving one specific problem. And that’s how they made it happen, learning along the way.

What most people have are processes, tools, and education, but what they lack is the mindset and networks. However, when you have all three, you can create a real change.

How to establish networks?

JESSE: That's a great way to sum it up. So, given that networking is so important, what can we actually do on the day-to-day job to get started in building better networks?

MIKEL: First, for me network is about the mind and about the art of living and the state of being. It’s the realization that it’s all about the people surrounding you. Once you acknowledge that, it should become your everyday job to always interact with others, and always be curious.

If I should give a more practical advice, well, it starts with a deep sense of self-awareness. What problem do you want to solve and what are you passionate about? When you are able to identify that, you can then ask the right questions. It will make you curious and engaged in a conversation, and usually this attracts a lot of people to you, they would be fascinated by, as I say it, your sense of belonging to a specific topic. This way people end up coming to you.

Once you identify a problem and you become obsessed about it, establish your why, then what and finally, how comes later. And if you have a network, it all becomes so much easier, because this all these people are thinking about.

So, in short, my first tip is to build self-awareness, by telling the story of what and why, and why you want people to go on this journey with you.

The second one I believe is extremely important and it is cross borders, blow up borders. What I mean by that is: change the department, change the company, your discipline. Go to a meet up that is not related to your activities. Talk to that person, even if you think there is no value. And if you can, go abroad, change culture, change the continent. Do anything that will really expose you to multidisciplinary activities. This experience is extremely helpful in building networks.

In my book, I give example of Carl Djerassi, one of the chemists behind the birth pill. He was born and grew up in Vienna, but during the Nazi time escaped to Bulgaria and later moved to the U.S. In the U.S. he found himself not fitting with the system, switching to university, academia, then back to university. At the end, he launched several companies, became a published author, an artist and so on. What he was saying was that all these different experiences were bringing the best ideas. So, multidisciplinarity is extremely important.

A third way to build networks, and believe me, people are really behind this one – it’s the ability to give without asking anything in return. I think statistically, we are like in the 70-90% range of takers.

Traditionally, this has been normal. Companies were always transactional. You give, you get. the company gives you a job, you get a salary. But today we live in a different world. We live in a world of caring. This is also reflected in the day-to-day jobs, the hierarchies are getting flat. It means everybody should care for one another.

In the startup world, in the [innovation] ecosystem world it’s about helping others. Usually, entrepreneurs will never have enough return to provide you, usually they are studying, and they don’t have enough money. So, you cannot just wait for shares every time you talk to an entrepreneur. You cannot expect to always get something.

So, it's all about, how can I help that person. All around in the ecosystem it should be all about helping that person. That’s actually a mantra of Brad Feld, one of the founders of Techstars. And it is something I am trying to push because we are so behind this. I see it absolutely every day in polls, in meetups.

Last week I was attending Viva Tech, I was talking to this guy who wanted me to make an introduction and he said “oh, I will give you a call next week and we can establish a contract”. And it’s not something we do. So that’s the kind of mindset that I am trying to change.

JESSE: I think those are great tips! First really diving in the topic and starting to work on something, working with other people who are passionate about the same topic, and focusing on giving first.

How to create an innovation ecosystem

JESSE: I want to transition to innovation ecosystems. It’s obviously a term that's pretty hot right now and a lot of people are talking about it. But it seems that most people have a slightly different take on what it means and why is it necessary for corporations to build one. What's your take on the topic?

MIKEL: First of all, why are we talking about innovation ecosystems? We live in a very interesting time. There is a study called Lifting the Lid on Corporate Innovation in The Digital Age that showed that in 2015 only 4% of corporations were using startups for their innovation activities. 4% - that is absolutely nothing and that study surveyed 320 global companies. That number will increase to 40% by 2025 and innovation labs will increase by 70% of innovation activities by 2025. 20 years ago, it was just R&D and you had almost no interaction with the outside world.

The future looks different. It looks that almost all of your transformation capabilities will be external. And if you look at this fact, you already have the answer to your questions. Do you need to engage with the innovation ecosystem? Well, if you don’t, you can say bye to your transformation, bye-bye to your innovation, because you won’t get access to new technologies, IP and so on.

So, why? Because that’s the future.

Why do we do external innovation, is because we live in a very fast changing world and digital technology, specifically, is accelerating the way we implement new things on the market. And because of that, companies cannot do it on their own. Or they could, but it would take too long. So, to speed up the process, there is no other way than to partner and invest in external companies. This is why they should know what an innovation ecosystem is.

I think there is another important thing to highlight. I talked to a lot of top management people, and they do not understand the innovation ecosystem. They only see startups, and that is a huge focus.

However, I worked with global expert in innovation ecosystems, Susan Windham-Bannister. She is a former CEO of $1 billion fund in Boston, Massachusetts and she was leading this innovation ecosystem transformation in Boston.

When you have a thriving and functioning innovation ecosystem, you get sustainable innovation, it means you can have a new innovation over, and over again, it keeps just going. Bannister called this innovation capacity.

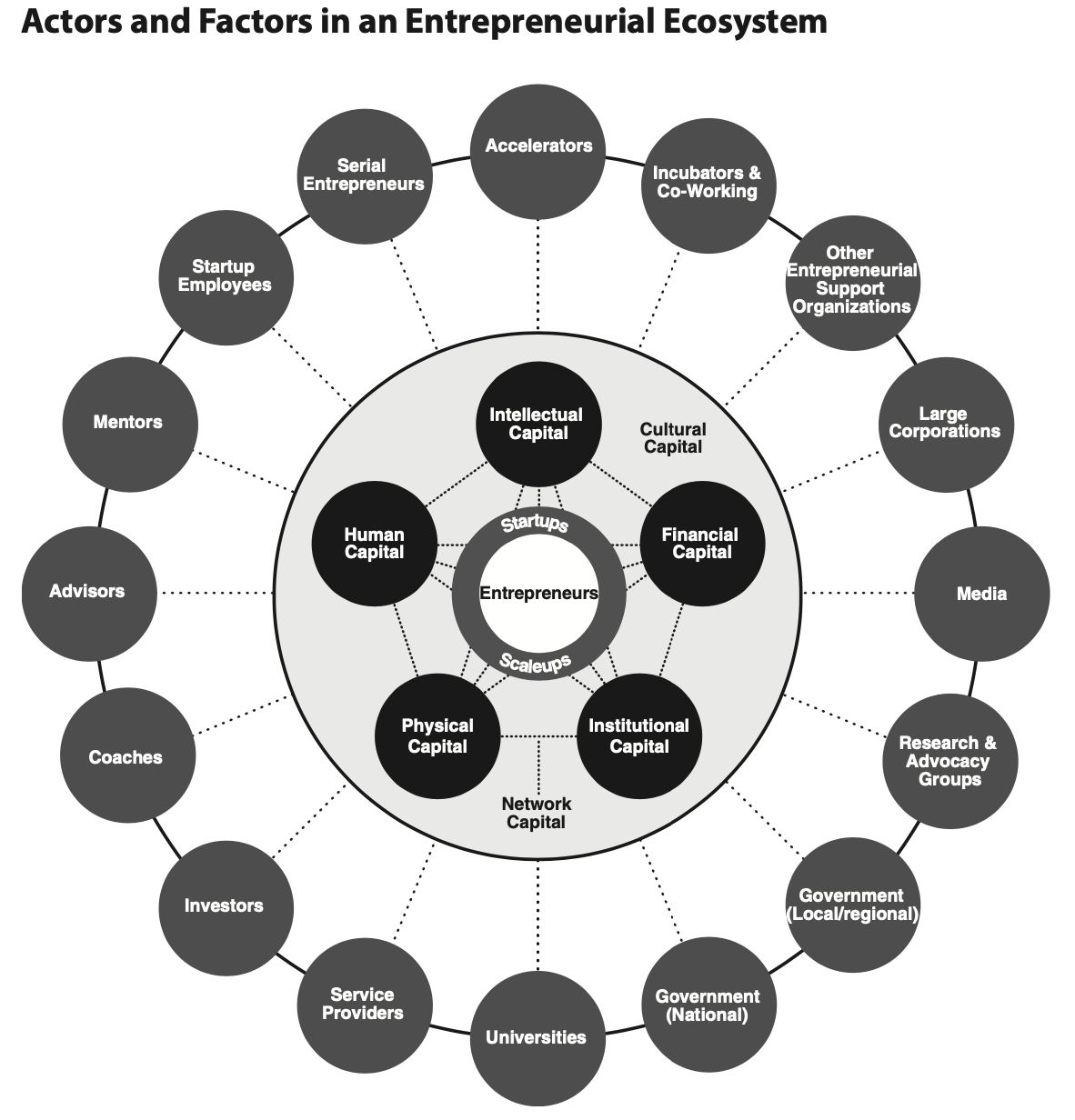

How do you create it? In the different parts of the ecosystem. For example, in healthcare, it means having mature companies, startups, top universities, production facilities, scale up manufacturing, accelerators, incubator spaces to host all these people. Then, you also have the service-based side of the organization, like CRO, legal and so on. Of course, you also need medical space, medical centers. You basically need all these pieces in the same space.

We can of course talk about global or digital, but today we are talking about the local ecosystem. So, first, does your city, your region have one? This is the first question to determine. Then the first step is to identify all the players in the ecosystem and how to engage with them. Otherwise, you don’t have access to the latest information.

This isn’t only about startups. Companies should engage on multiple levels. They should scout startups, yes, but they should also help startups. Sometimes it can be through grant programs, sometimes through different events organized together with the city, to promote entrepreneurship, sometimes it’s through education.

If you want to work in a strong ecosystem, then maybe you can also participate in educating or transforming that ecosystem. For example, in San Francisco, you have Genentech sponsoring this biotech week where they invite a lot of students. Then there’s SAP coding initiative, where kids are coding. Companies today have more to play with than before. It’s not just the governments that are setting entrepreneurship. Entrepreneurship should be set by companies and all the players.

A strong and powerful innovation ecosystem is when you create an environment where entrepreneurs can start a company because they are going to have access to capital, they can grow and scale a company and they want to stay in the innovation ecosystem.

Successful ecosystems are made by serial entrepreneurs that reinvest in the community.

JESSE: If we dive into more details, when it comes to building an ecosystem, many companies seem to want tangible business results before they think they can invest time and effort into it. Is that realistic, or should you first just focus on creating value for the community?

MIKEL: I don’t believe in the all or nothing approach. To me, it seems a bit narrow-minded to say, “oh if I will give something, then I will not deliver my business results”.

I believe you can do both. It is true that all of the innovation units should not be innovation just for others, as we know it. We’ve seen this happening, a lot of people just showing fancy pictures, fancy offices and three years later, it gets shut down because they do not deliver business results. I think this is part of the problem we are talking about.

In the end you’re still a company, so I believe that the number one KPI should be the revenue. But it does not mean that the company and the group cannot participate in such programs It might not be up to the innovation team. The innovation team has to be focused on sustaining tangible results, building ventures, investing in startups.

The company should play a role here. It could be another unit, perhaps the cultural unit of the organization that is trying to participate with the innovation team and asks, “what can we do about it?”. It’s just that the time, of being a taker and only getting something, without giving anything in return is over, even for businesses.

There is a good book on the whole concept of providing value to society, Net Positive (How Courageous Companies Thrive by Giving More Than They Take), by Paul Polman and Andres Winston. Paul was the CEO of Unilever. In the book he was talking about all the initiatives that they were doing for communities. That’s the kind of thing that I believe companies should do.

Companies like Unilever or Patagonia are doing a lot. And this is why we need a brilliant innovation ecosystem. It should be all about helping entrepreneurs.

Best practices of building an innovation ecosystem

JESSE: If you look at the side of helping an organization to build an innovation ecosystem, that's obviously something you've seen others do and that you're working yourself on, do any best practices come to mind that are important to consider during the process?

MIKEL: What I believe is important, which I also cover in the book, is to have skin in the game. So, what it means in business terms, is when you really put your own money into it. I’ve interviewed a person in real estate. I know it’s a little bit outside [innovation ecosystem], but he is working on these huge complexes, worth hundreds of millions.

He said that when he starts a project, he always owns more than half of the risks. So, he is putting his money and creating credibility and reliability. When you have your first project, you create this network of people around you to help you, all the co-investors. In the second project, they are all showing up again, and again.

So, in a way it is exactly the same in the business world. Imagine you do your first initiative, you put your own money to sponsor an event, you show an example, you do it multiple times and that creates and incredible brand and reputation within the ecosystem.

What are the best practices?

First, don't wait for everybody to do it! I always go crazy about this. We don't always need to be followers. Usually, people want data that someone else has done it, but the best practice is to build connections with all the elements in the ecosystem.

Most cities have connections to these public-private organizations. Like, in Germany, in Berlin it’s Berlin Partner, in Basel Switzerland – Basel Area, Boston – Life Science Center and so on.

To be honest, the first step is to go to these organizations, because there’s money there. They get funded by the government, but it is semi-private, they get money from the banks and so on. The goal of these organizations is to help you participate and to connect to the ecosystem.

The next step is to make connections to accelerators, incubators. They can invite you to demo days, you can participate and even co-organize, sponsor these events. You are helping these accelerators to try and have more entrepreneurs.

Go to a lot of meetups. What I realized when I was in San Francisco was that they had an incredible meetup culture. People say, “oh yeah, we also have events”. Yes you have events, but two per week. In San Francisco they had 50 events a day. And that’s in a city of 800,000 people. It was inclusive and open to everybody; it wasn’t invites only. It was free, sponsored by one of the companies, helping people to connect and exchange.

Go to events to these public-private organizations. That creates the backbone for the ecosystem. Then help accelerators/ incubators by sponsoring, attending, or promoting their activities.

Then it all comes back to identifying the players. Once you identify them, you just make interactions with all of them. If you are an investor, you have to build connections with other investors, because what I realized is that all of them are interested in co-investment.

They do not go in a deal alone. Therefore, it’s very helpful to build this relationship, sharing your deals, and when the deal is coming, you can co-invest as a community. That really helps the ecosystem because more investments will be made and so on.

So, this is what is really building this relationship, trying to find a way to collaborate.

JESSE: We’d like to hear your thoughts on the topic of corporate venture capital. What are the differences between the two in terms of mindset and what are the challenges in doing corporate venture capital right?

MIKEL: I'm happy to share about the topic. I start with the disclosure that I'm not making the investment per se for my company. I work with the investment team and the investment team has its own processes. I participate and recommend startups because I'm scouting. I am not the one who makes the high-level decisions.

So, let me explain a little bit my experience so far. I would start with the VC culture in Silicon Valley. The VC culture in Silicon Valley is another game than the VC culture that we know here.

They take the most risk, they invest in crazy companies, they fail a lot, but they are asking for moon shots. They want billion-dollar opportunities, and they are doing crazy bets. Often, the whole purpose is a wild return on investment. At the same time, they also want an interesting portfolio. But it's really having a lot of return in terms of money.

That's why the most successful ones take the most risk, but they also lose a lot of money. One deal out of 100 that becomes a world leading company can save all of the failures. That’s why Sequoia Capital has backed Google and all these companies. So, that's the VC culture in Silicon Valley.

Now if you look at CVC, it's a completely different approach. You don't just look at return on investment, and money. And you don’t take the most risks. What companies are trying to do is to transform themselves to have the capabilities and the technology that will be relevant in 10 years from now.

Companies are trying to transform themselves to have the capabilities and the technology that will be relevant in 10 years from now.

The technology is very important and the IP Is even more important. So, what are the kind of patents you can acquire? Are they in the market? That’s when they know they have to increase their market share. So, they will invest in companies that can go into new markets, acquire new technologies, including the IP. That will help them transform and be relevant in 10 years from now.

That's my understanding of corporate venture capital and while they might do it for the money, they actually lose money in the short term. But the main idea is to have this competitive advantage 10 years from now.

Why is it a trending topic and why is it relevant today? Well, every company has now technologies that will not be relevant 10 years from now, especially because a lot of these companies do not have digital products and digital connected products are the future. So, they will need to do that because employees are not into the new technologies that are needed.

So, the only way you can do it fast is to acquire or invest in this novel companies.

What are the difficulties of corporate venture capital?

Well, I would say it starts with the people you recruit to do the CVC fund. I was talking to a large global chemical company ($3 or $4 billion dollars in sales) who said that they were recruiting for the top investors that will lead the fund for one year. They already had some people, but they needed that kind of V. C.

It is extremely hard for companies to hire people that have experience in venture capital, that know the game and that could lead the portfolio initiative. If you're not a company like Google or other famous brand, what is the incentive for the VCs? If they can do it for themselves, they can make so much more money. Why would they join a company that is often much more rigid?

In such companies it’s a lot about strategy, the budget, and the technology, not about investing in the companies you like. Then, there is a need for consensus and alignment with the management. So, you move a lot slower, there are a lot of roadblocks, and you have less freedom in terms of investments. Usually, they can be much more successful outside.

Companies are struggling to get people and then if you don't get the right people, then probably you don't do the right investment.

So, there are the two models. First one is the best but if you don't get the people usually you don't produce tangible results. And the other one, when an external VC is managing the company’s money is very hard because it's a conflict of vision in the way of working.

The last comment is about a McKinsey study on M&A saying that it is the most efficient strategy to transform a company, but it only works if companies invest almost on a quarterly basis. It’s not about waiting for the best deals, but about consistency. Just keep doing it, keep investing for a period of time. You will have failures, but that’s the most effective way of doing it right.

JESSE: I know you're also passionate about what the world Economic Forum calls The Great Reset. What is it for those, of us that aren’t familiar with the term and what's your take on it? Why is this such a pivotal opportunity for us as a society?

MIKEL: An interesting quote that I’ve heard it was few days ago in an event that I was moderating, it was an executive vice president of a startup unicorn and he said “never miss a good crisis”.

We have heard that from many entrepreneurs that sometimes, and actually often, the best companies are born in a crisis, right? For example, Uber, Airbnb all these other companies were born in the crisis of 2008, many other companies were born in the Internet bubble crisis. It starts like this.

Right now, we are facing a huge crisis. The crisis of today is that we run on an economic model that is really damaging and it won’t change if we continue the way we work. One of the biggest issues is that we still run on this kind of quarterly basis, where companies get bonuses and boards get bonuses, and it’s all about shareholders.

So, you plan for the very short term, and you always think short term. You think, how can you get this profit base, to increase your stock, to report on the quarterly meeting that everything is fine. Usually, if you're on the board, you're there for three years, you get your bonus. Why would you think more than three years ahead?

In the book Net Positive, Polman is talking about the multi stakeholder economy. He is suggesting that we should remove the quarterly reports and we should be much more stakeholders driven, making sure that all our stakeholders involved with our company are doing well. Thinking long term, and stopping the so-called shareholder supremacy.

The Great Reset isn’t a new approach, it has been around since the 80s. The founder Executive Chairman of the World Economic Forum has written a book on the topic. You should care about all the stakeholders of your company, your suppliers, the producers, logistics, etc. You end this cycle of cost saving everywhere to just have maximum returns, just to get shareholder appreciation and value.

There is a very strong need to stop that and it will happen. Companies are going to be forced to do that. Everybody’s watching. Companies are not doing it right, but today, we have an empowering tool called the Internet. Believe me, companies will be on the spotlight.

We’ve seen this with Disney and the controversy around them filming in China.

In the end, every company that is not doing what’s right, will be pointed out. It can completely destroy the value [of a company].

So, my message is: do what is right, think long term, stop short term profits, and take care of all your stakeholders. This way, the whole society will be better, we can start solving problems and we will also be able to build innovation ecosystems.

Do what is right, think long term, stop short term profits, and take care of all your stakeholders. This way, the whole society will be better, we can start solving problems and we will also be able to build innovation ecosystems.

JESSE: Awesome! Any closing thoughts you'd like to share before we wrap up?

MIKEL: Well, my closing thought is that we actually live in a very, very interesting time. And the opportunity is that anywhere you are, any position you have, any knowledge you possess, you can build networks easily, through digital technologies, to create a positive change. Even only 10 years ago, we didn’t have this opportunity.

My message is that everybody should be aware of this incredible chance that we have. Everyone should realize that today, it's so much more about bottom-up and networks, than any kind of power, money thing. Through social media, through digital technologies to just share what you believe in. A lot is possible.

I hope people listening will realize that we can create positive change and it's not impossible if we join forces.

JESSE: Awesome. That's the perfect note to end our discussion on. Thank you so much for taking the time to share your experiences and thoughts with us and our audience Mikel.

Interested in Innovation and Leadership?

Join 90k+ other monthly readers and subscribe to our blog to get the latest stories on innovation, leadership and culture straight to your inbox.

.png)