How To Manage an Innovation Portfolio

Your company is innovating all the time. But you may not know it. In many companies, innovative ideas are not managed effectively. Or they’re not managed at all.

The jeopardy faced by many maturing, medium-sized companies is that valuable innovations, potential blockbusters, are buried in the day-to-day grind.

Getting out existing products, and managing them well, is hard enough. As a result, too many companies are passing up opportunities, or arriving in the market too late because they cannot get their arms around the early stages of innovation.

They do not see that even at their earliest stages, new ideas, however vague, are a valuable asset and need to be managed as one.

New ideas, however vague, are a valuable asset and need to be managed as one.

The key is to have a governance structure in place to manage and fund innovation, and a lightweight process to select and shepherd the very best early stage innovations.

Table of contents

Managing Innovation as a Portfolio

At their earliest stages of development, product concepts are often nothing more than a drawing, several sentences sent between team members via email, or a dream a senior manager has had since college.

Ideas appear in unpredictable ways and from all levels of the organization. These ideas that bubble up from the bottom are the key to long term growth, but many companies, especially middle-sized companies, fail to manage them as an asset.

Many people think that there is nothing there to manage, yet. While that might be true for a given idea, you must also consider the potential value of the sum total of these innovations. Think of them as a portfolio that can be managed.

Companies can clarify product concepts and reduce risk at the earliest, embryonic stages of the product life cycle by redefining a motley collection of concepts as a portfolio of potential products.

Companies can clarify product concepts and reduce risk at the earliest, embryonic stages of the product life cycle by redefining a motley collection of concepts as a portfolio of potential products.

Within that portfolio are a range of assets of widely different value, how can companies ensure that they’re investing in the most valuable assets in its portfolio of napkin-level ideas?

In three ways.

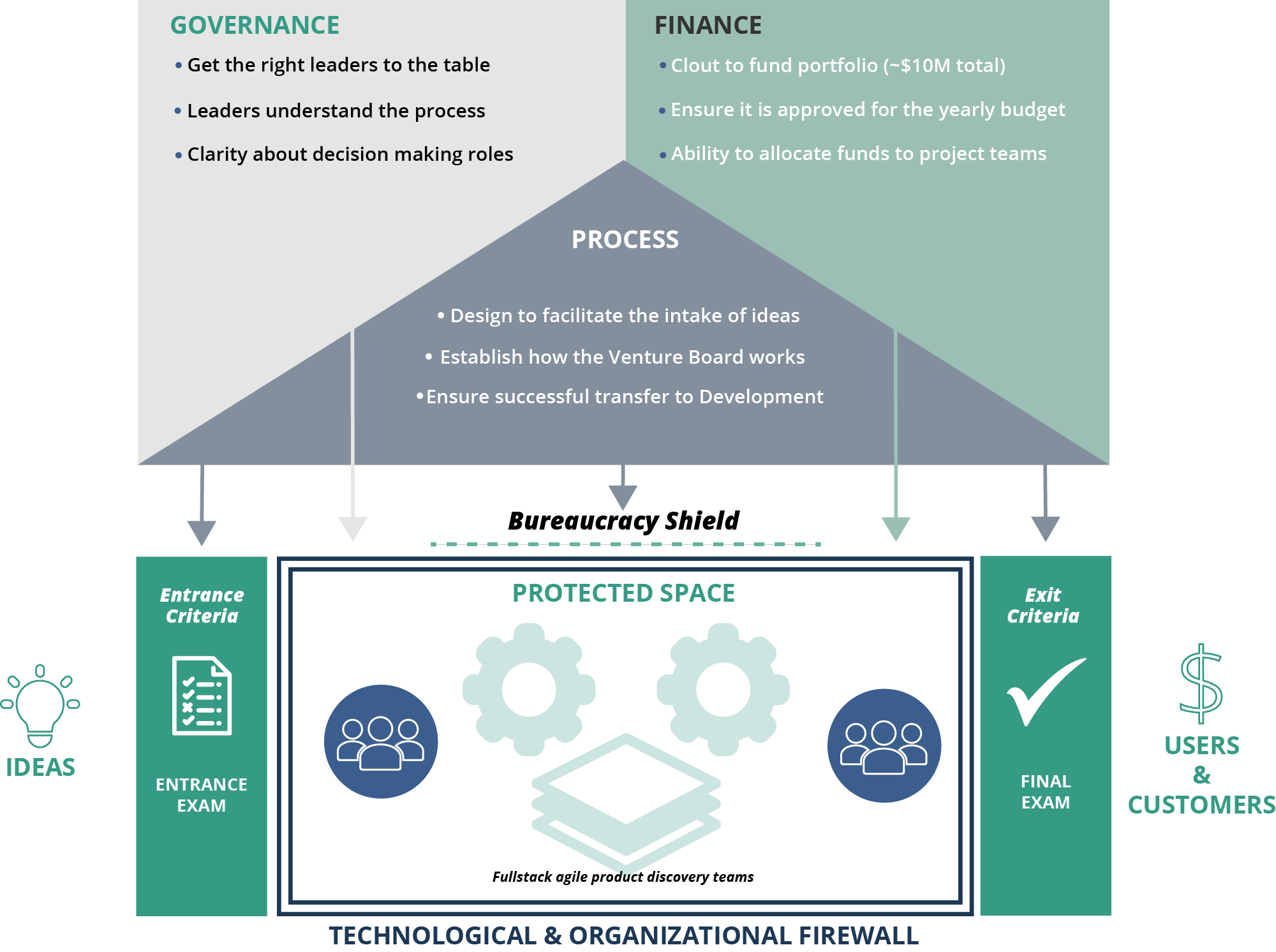

First, companies need a governance structure empowered to look at early stage product concepts, and nurture the best of them within a protected space. Then, it needs targeted funding to explore the potential of these ideas. And, finally it needs a process for vetting and selecting the very best ideas.

A Governance Structure for Innovation

As mentioned, an early-stage product portfolio management process requires a governance structure.

Typically, a senior team, including the major functions involved in strategic planning for product development (Marketing, Engineering, etc.), oversees this process. This team establishes a short list of criteria for approving product concepts and moving them into the pipeline.

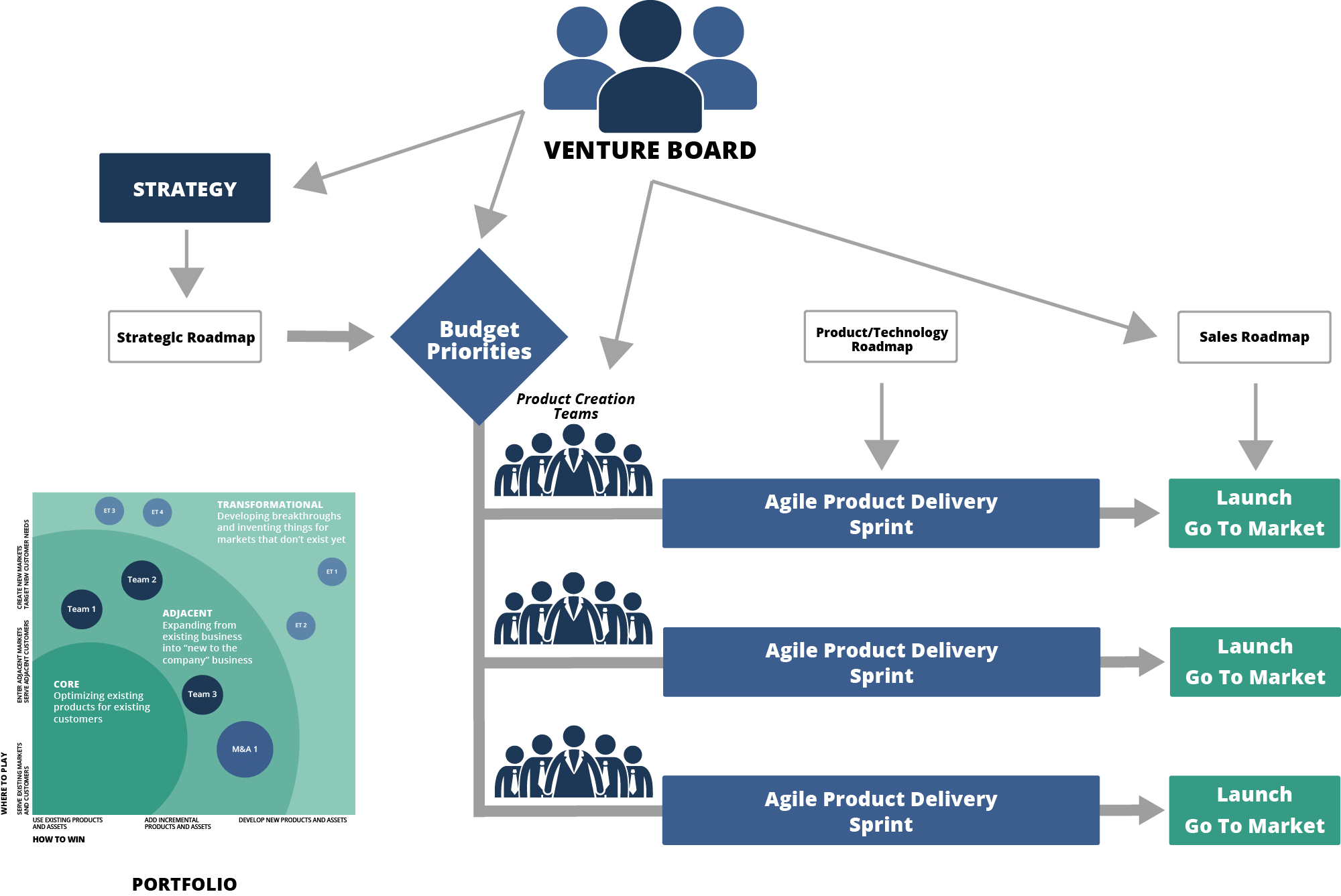

This senior team should think of themselves as venture capitalists funding and nurturing a start-up with an innovative new concept. We call it a Venture Board.

The Venture Board evaluates new ideas and invests in the ones with the greatest potential. Projects compete for funding from this board. The Venture Board not only selects and funds new ideas, but it also places a protected space around them.

Above all, the Venture Board brings together the leaders who are empowered to take raw ideas and turn them into developable products.

The Venture Board also owns and manages the portfolio of innovations. It approves projects, or segments for investment, managing their resources and budgets. As the owner, the Venture Board is responsible for ensuring and maintaining strategic focus for the portfolio.

When it comes to approving investments, Venture Boards should not erect ‘Gates’ that require a team to undergo stressful and time-consuming reviews.

The most effective Venture Boards have a C-level executive leading them. This is often the CEO/GM or a Chief Product Officer or VP-Products. It is best when the executive in charge is a business leader with product development experience under his or her belt, and a strategic perspective.

The Venture Board must also create a protected space around innovations that shield them from bureaucracy. Think of each project in the portfolio as an internal start-up incubated within that protected space.

The Venture Board not only selects but also continues to champion innovations as they develop. Its purview includes encouraging any cultural changes required to support innovative ideas.

In essence, the Venture Board is the owner of the innovation portfolio and it is responsible for maintaining a strategic focus.

Funding Early Stage Innovations

Funding an innovation portfolio entails a substantial budget earmarked for innovation – especially for innovations that appear unpredictably, and yet have too much potential to wait until the next strategic plan.

In the annual budget, create a line for strategic innovation and approve it in the budget year. It should be big enough to support at least three projects. In our experience, approximately $10K per employee is a good guideline.

With an overall budget, that amounts to between 2% and 20% of sales, the Venture Board’s challenge is to select the best investments within the different types of assets in its innovation portfolio.

The right mix of investments depends on the company’s tolerance for risk and the maturity of its development efforts.

Too many companies fall into the trap of thinking that high investment implies high risk, and hence high reward.

Too many companies fall into the trap of thinking that high investment implies high risk, and hence high reward. Skilful and moderate levels of investment at this stage can actually produce better results, since the main deliverable is simply a demonstration of the potential of a product and its fit with the overall strategy, not a growing business at this point. Typically, a larger company in a mature industry would allocate 70% of its budget for innovations within its core business, perhaps 20% for market-adjacent projects, and 10% for truly innovative, potentially disruptive ideas. Such an approach is actually fairly conservative.

Typically, a larger company in a mature industry would allocate 70% of its budget for innovations within its core business, perhaps 20% for market-adjacent projects, and 10% for truly innovative, potentially disruptive ideas. Such an approach is actually fairly conservative.

Tech startups that do not yet have an established market might allocate investments for innovation differently.

They tend to allocate less of their budget to core products, perhaps less than one-half of the available pool, or around 40%. They might allocate another 40% for innovative ideas in adjacent markets and the remaining 20% to truly transformational projects.

There is no one-size-fits all approach, but the examples above should help.

A Process for Early Stage Innovation

Having a governance structure and proper funding for innovation is a great start. However, companies then need to manage the product portfolio through a formal process with a small footprint.

This product portfolio management process designates even early stage product concepts as projects that are aligned according to a company’s strategic priorities. It has milestones for moving product concepts into the pipeline and considers how to staff them, and how to reduce risk.

Once companies have their investments in place, they can move innovative new ideas into a Discovery process and then into product Development. The Discovery process creates a protected space where fragile innovations are shielded from corporate bureaucracy, where they can grow freely and demonstrate their potential.

During Discovery, project teams frequently make contact with external and internal customers. In an Agile environment, the Discovery period may entail more than one sprint. The initial phase of the product portfolio management process ends with the formation of a project team. In the second phase, the team demonstrates that the concept is both feasible and sufficiently defined to transition into the pipeline.

The initial phase of the product portfolio management process ends with the formation of a project team. In the second phase, the team demonstrates that the concept is both feasible and sufficiently defined to transition into the pipeline.

A process for managing product concepts also includes a set of deliverables and clear entry and exit criteria, governing what goes into and out of the portfolio of possible innovations.

These deliverables might include:

- A market assessment

- An assessment of commercial viability

- A business case

- A technology summary

Clear entry and exit criteria are essential so that project teams and managers alike understand the rules governing the innovation process. To ensure that both the teams and the governance body are on the same page, create Entrance and Exit Criteria along the lines of these examples:

Entrance Criteria: Move from idea into Discovery (protected space)

- Ensure that ideas are congruent with the vision

- Ensure the team is free to innovate and iterate

- Ensure that projects are staffed properly with the right resources

- Ensure that projects are free from anything that impedes fast and iterative development

Exit Criteria: Move from Discovery into Development

- Confirmed market/product fit by testing prototypes with users

- Vetted the technology and removed significant realization risks

- Defined use cases and have prioritized where the solution best fits

- Estimated development stage costs and created a plan for development

- Confirmed commercial potential (including profit potential)

- Ensured that the dev organization has the budget to support Go To Market

- Team has a tested leader (Product Owner or Developer)

While an orderly innovation process has clearly defined Discovery and Development stages, as well as entrance and exit criteria, within these stages there are very few rules.

Inside this protected space, strategic fit and the market potential of the projects are the focus. The team should be empowered and enabled to develop the potential of new ideas in relative freedom.

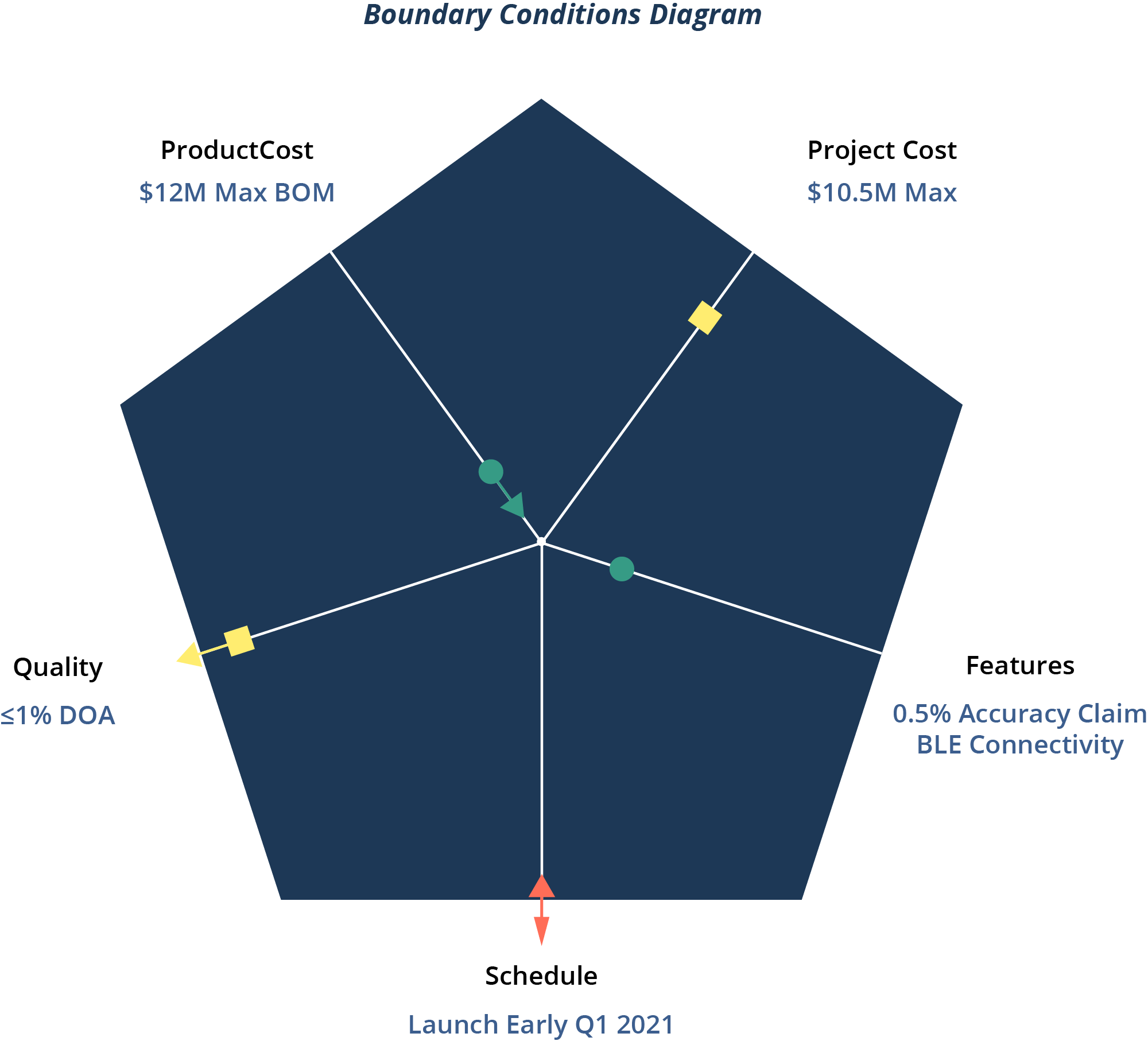

That freedom, however, comes with a responsibility. Management must be able to trust the team, and for that, it’s important to set clear boundaries for their work.

An effective way to do that is through exception management. The team will have a few key parameters that the Venture Board expects them to hit, such as the examples you can see in the diagram below. Beyond that, the team is empowered to complete the job as it sees fit, as long as it stays within defined parameters.

Summary

Innovative processes and products, those germs of ideas that might become the next blockbuster, are of enormous value. Unfortunately, too many companies do a poor job of managing them systematically as a portfolio of assets.

There’s another way. In short:

- Build a structure for governing and incubating, early stage concepts, that mirrors aspects of Venture Capital.

- Fund the best innovations by allocating budgets in real time from a pool of investment capital. Tailor these investments to your markets and tolerance for risk.

- Create a process that protects the integrity of early stage innovations.

Have an overarching vision and invest accordingly – not according to a rigid plan, but in an agile fashion, in response to change.

The front-end of innovation is notoriously nebulous and difficult to manage. But teams and managers working together can do a great deal to clarify the early stages of development by redefining innovative concepts in terms of a product portfolio, along with a clear process for managing these assets.

By placing even a minimum of governance, and carefully managed investments around these early stages of product development, companies can eliminate many uncertainties, mitigate risks, make better product selection decisions, and increase the value of new products over time.

Interested in Innovation and Leadership?

Subscribe to our blog to get the latest stories on innovation, leadership and culture straight to your inbox.